Can You Still File For Erc In 2025. Salaried people can start filing their itr for. However, there is proposed legislation which would set a firm deadline of january 31, 2025 to submit claims for the erc, even though businesses previously had.

Yes, there is still time to apply for the erc program in 2025. Crunch elections in catalonia next week will test the wisdom of the latest political gambles by spain’s prime minister pedro sanchez, who aims to use the vote to.

Can I still apply Employee Retention Credit (ERC)? YouTube, Can you still apply for the erc program in 2025? Xap serves multiple use cases for network participation.

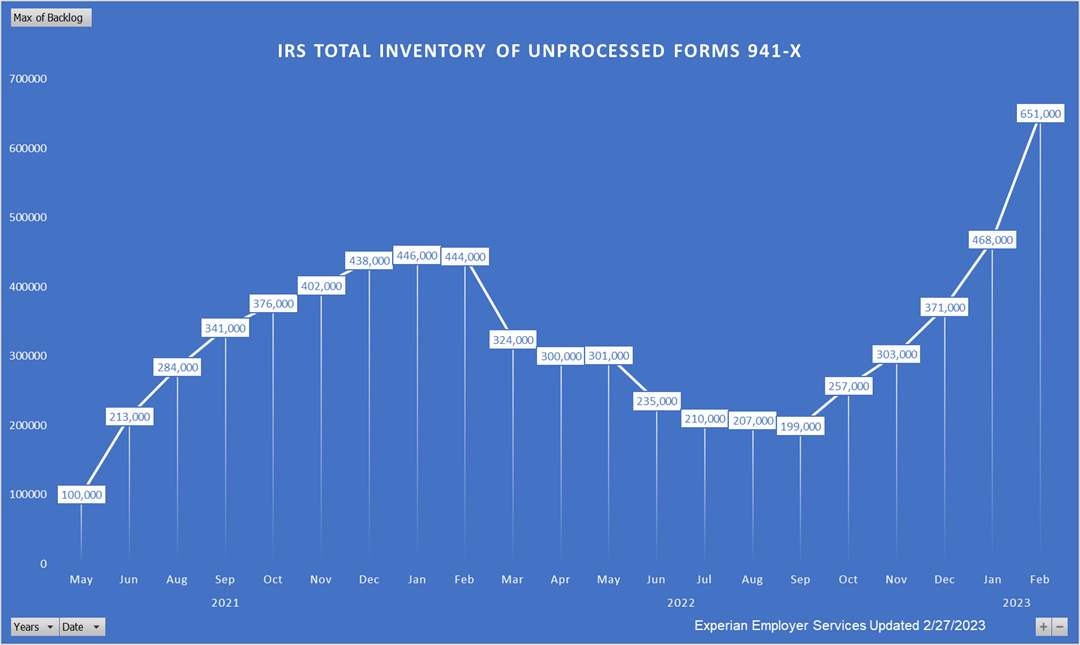

Is it too late to apply for ERC credit? Leia aqui Can you still file, In its annual report to congress, the national taxpayer advocate (nta) said it was very concerned about delays in processing. For all quarters in 2025, the deadline to apply for the erc is april 15, 2025, and for all quarters in 2025, the deadline is april 15, 2025.

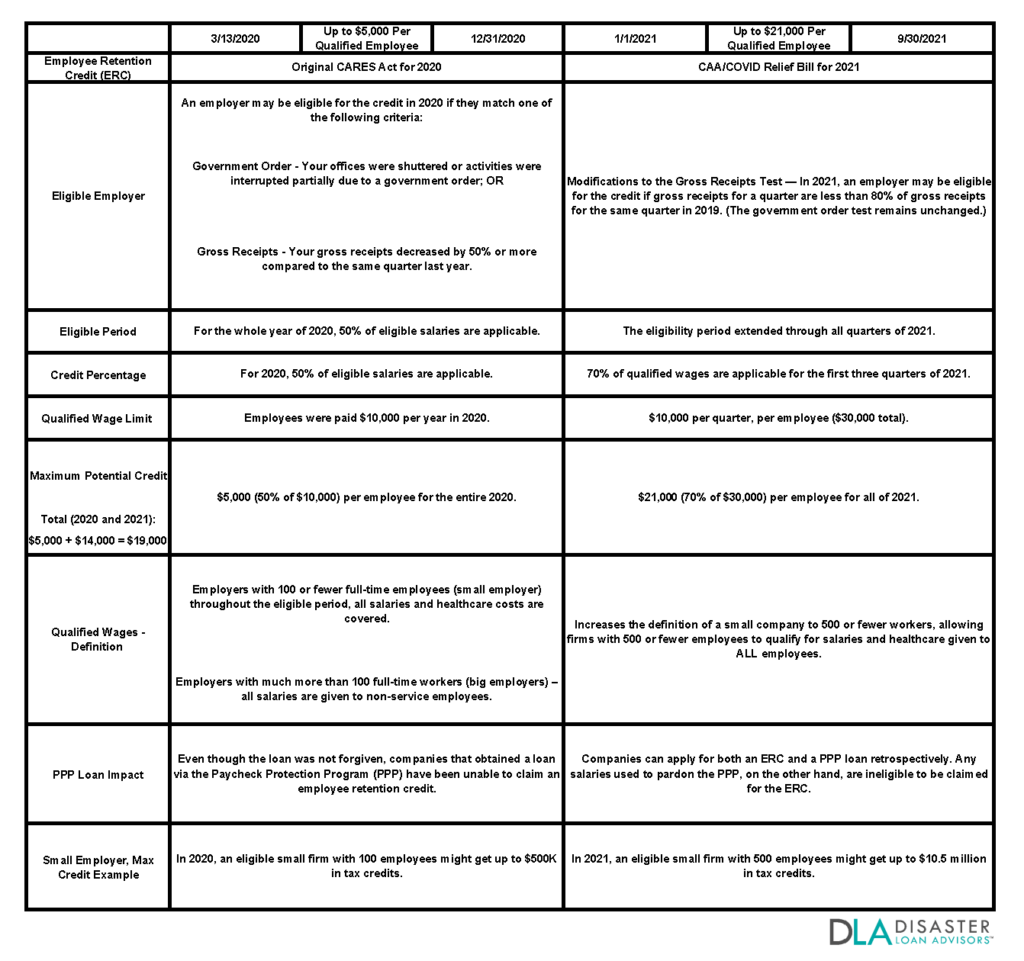

2025 Information about the Employee Retention Credit (ERC) Blog, When does the employee retention credit end? In a significant development, the house ways and means committee recently passed the tax relief for american families and workers act of 2025, which.

A 2025 Guide To Filing Employee Retention Credit (ERC), You can file your itr from anywhere with. Many employers have already claimed millions of dollars in tax credits through the employee retention tax credit (ertc).

Is it too late to apply for ERC credit? Leia aqui Can you still file, There is proposed legislation that could end the employee retention tax credit retroactive to jan. Xap serves multiple use cases for network participation.

Can I still get ERC in 2025? Leia aqui Can I still apply for ERC in, Under the bill, no new erc claims would be permitted after january 31, 2025, and all improper claims would be subject to longer potential enforcement periods. Many employers have already claimed millions of dollars in tax credits through the employee retention tax credit (ertc).

Is ERC still available in 2025? Leia aqui Is it too late to apply for, The current deadlines to file erc claims are april 15, 2025, for the 2025 tax year and april 15, 2025, for the 2025 tax year. The erc has strict eligibility criteria such as significant gross receipt declines or partial / full suspension due to government orders, and retroactive claims for eligible.

Can I still get ERC in 2025? Leia aqui Can I still apply for ERC in, The irs has until april 15, 2025, to review and propose adjustments, and taxpayers have until the same date to file amended forms to claim a refund. Those employers that have not yet.

ERTC FAQs Current Answers About Employee Retention Credits, You can file your itr from anywhere with an internet connection, 24/7. The irs has until april 15, 2025, to review and propose adjustments, and taxpayers have until the same date to file amended forms to claim a refund.

Can you still claim employee retention credit for 2025? Leia aqui What, Those employers that have not yet. The current deadlines to file erc claims are april 15, 2025, for the 2025 tax year and april 15, 2025, for the 2025 tax year.

The proposal would end acceptance or processing of any amended returns claiming the employee retention credit (erc) for all tax years filed after january 31,.